Over the years, I’ve worked with hundreds of clients across various industries—from healthcare providers to property managers, trade schools to law firms. While most clients want the same thing—results, professionalism, and transparency—many unintentionally make avoidable mistakes that limit their success with a collection agency.

If you’re outsourcing your accounts receivable to a third party, it’s important to know that collections is a partnership. The more aligned we are, the better the outcome.

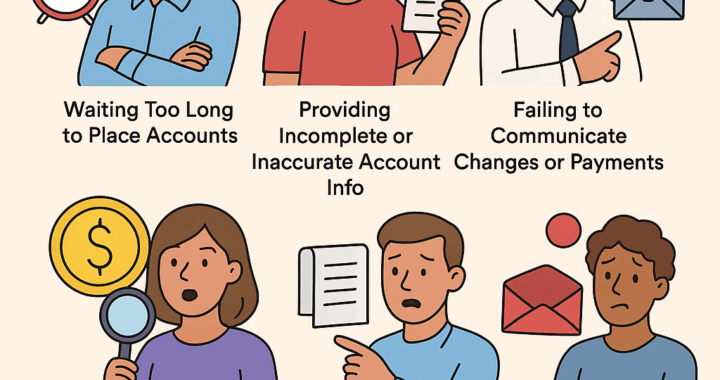

Here are some of the most common mistakes clients make when working with a collection agency—and how to avoid them.

- ⏰ Waiting Too Long to Place Accounts

One of the most damaging mistakes is holding onto delinquent accounts for too long. Some clients wait 6 months, 1 year, even 2 years before placing accounts—by then, the chances of recovery have dropped significantly.

🧠 Best Practice: Place accounts within 90–120 days of delinquency. The older the debt, the harder it becomes to collect due to outdated contact info, broken communication, or legal limitations.

- ❌ Providing Incomplete or Inaccurate Account Info

We can’t collect what we can’t verify. Incomplete files—missing addresses, phone numbers, dates of service, or signed agreements—slow down the process and expose both of us to compliance risk.

🧠 Best Practice: Submit full account documentation upfront: invoices, signed contracts, payment history, correspondence, and anything that supports the validity of the debt.

- 🤐 Failing to Communicate Changes or Payments

If you receive a payment or settle directly with the consumer after placing the account with us—but don’t notify us—it creates confusion, duplicate communication, and potential legal liability.

🧠 Best Practice: Always notify your agency immediately of any payments, disputes, bankruptcy notices, or direct consumer contact. We’re on your team, but we need to stay in sync.

- 💸 Not Reviewing the Fee Agreement or Scope of Services

Some clients are surprised when certain accounts are billed at a higher rate—often due to skip tracing, legal forwarding, or small-balance minimums—all of which are typically spelled out in your contract.

🧠 Best Practice: Understand your agency’s fee structure, terms, and optional services. Ask questions. It’s better to clarify expectations upfront than to be surprised down the road.

- 🔍 Overlooking Performance Reports

Agencies that prioritize transparency will send regular performance reports. Ignoring them means you might be missing red flags—or opportunities to improve placement strategies.

🧠 Best Practice: Review your reports monthly. Look at recovery rates, closed accounts, dispute trends, and what’s not performing. Meet with your account manager to fine-tune your approach.

- 🧾 Sending Accounts That Shouldn’t Be Placed

Accounts that are still in insurance review, under dispute, or have open service issues shouldn’t be sent to collections prematurely. Doing so can damage your reputation and hurt the chance of resolution.

🧠 Best Practice: Vet accounts before placing. Only send those that are valid, past due, and where communication with the consumer has broken down.

- 🧊 Not Treating Your Agency Like a Partner

Some clients treat their collection agency as an afterthought or necessary evil. But a great agency can be a strategic extension of your billing department, customer service team, and legal compliance structure.

🧠 Best Practice: Keep the lines of communication open. Ask for feedback. Let your agency guide you on how to improve internal billing practices, documentation, and timing.

Final Thoughts

Working with a collection agency shouldn’t feel like a gamble—it should feel like an investment in improving cash flow and reducing risk. By avoiding these common mistakes, you give your agency the tools it needs to deliver results while protecting your business and reputation.

At Credit Counsel, Inc., we’re here to make that process smooth, compliant, and effective. If you’re ever unsure about how to get the most out of our partnership, just ask.

Remember: The best results come from strong partnerships, clear communication, and mutual accountability.

Need help auditing your placement strategy or reviewing your contract?

📩 Contact us today—we’re happy to help.