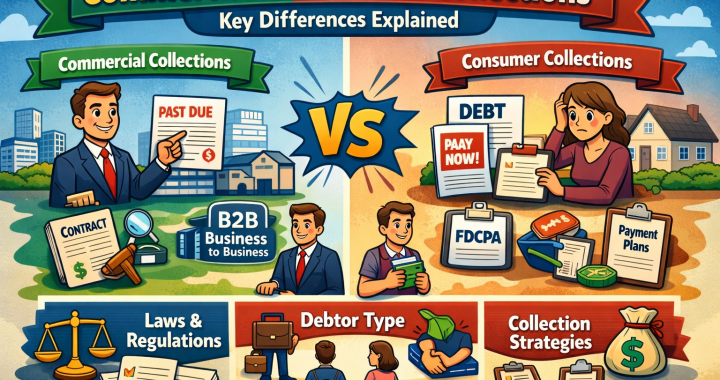

Commercial vs. Consumer Collections: Key Differences Explained

When it comes to recovering outstanding debt, not all accounts are handled the same way. Commercial collections and consumer collections differ significantly in terms of regulations, processes, strategies, and expectations. Understanding these differences is essential for businesses seeking recovery services—and for professionals working within the collections industry.

In this article, we break down the key distinctions between commercial and consumer collections to help you determine which approach best fits your needs.

What Are Consumer Collections?

Consumer collections involve recovering debts owed by individuals for personal, family, or household purposes. These debts often include:

-

Credit cards

-

Medical bills

-

Personal loans

-

Auto loans

-

Utility accounts

-

Retail accounts

Because these debts involve individuals, consumer collections are highly regulated at both the federal and state levels.

Regulatory Environment

Consumer collections are governed primarily by the Fair Debt Collection Practices Act (FDCPA), along with additional state-specific laws. These regulations:

-

Restrict contact times and methods

-

Prohibit harassment or deceptive practices

-

Require specific disclosures

-

Provide consumers with validation rights

Compliance is critical. Agencies must follow strict guidelines to avoid legal exposure and regulatory penalties.

Typical Consumer Collection Approach

Consumer collection efforts often focus on:

-

Structured communication processes

-

Payment plans and settlements

-

Sensitivity to financial hardship

-

Dispute resolution and validation procedures

Because consumers may be facing financial difficulties, negotiations often emphasize flexibility and resolution options.

What Are Commercial Collections?

Commercial collections involve debts owed by businesses to other businesses (B2B). These debts typically arise from:

-

Unpaid invoices

-

Credit terms extended to clients

-

Vendor agreements

-

Service contracts

-

Equipment leases

Unlike consumer collections, commercial collections are not governed by the FDCPA. Instead, they fall under contract law and the Uniform Commercial Code (UCC), along with applicable state laws.

Regulatory Environment

Commercial collections operate with fewer statutory restrictions compared to consumer accounts. While ethical standards and professional practices still apply, agencies have:

-

Greater flexibility in communication methods

-

Broader access to business information

-

More direct negotiation strategies

Because businesses are presumed to be more sophisticated parties, the legal framework allows for a different approach.

Typical Commercial Collection Approach

Commercial collections are often more direct and strategic. Key elements may include:

-

Reviewing contractual agreements

-

Evaluating credit applications and personal guarantees

-

Assessing UCC filings

-

Conducting asset investigations

-

Negotiating lump-sum settlements

In many cases, maintaining ongoing business relationships is also a consideration. A careful, professional approach can preserve future opportunities while resolving the debt.

Key Differences at a Glance

1. Legal Framework

Consumer Collections:

Highly regulated under federal and state consumer protection laws.

Commercial Collections:

Primarily governed by contract law and commercial statutes.

2. Debtor Profile

Consumer:

Individual person responsible for personal debts.

Commercial:

Business entity, sometimes backed by a personal guarantor.

3. Communication Restrictions

Consumer:

Strict limits on when and how contact can occur.

Commercial:

More flexibility in communication methods and frequency.

4. Documentation & Leverage

Consumer:

Focus on account statements, contracts, and payment history.

Commercial:

Emphasis on signed contracts, credit agreements, purchase orders, personal guarantees, and UCC filings.

5. Recovery Strategy

Consumer:

Payment plans, hardship accommodations, structured settlements.

Commercial:

Negotiation based on business solvency, asset position, and contractual leverage.

Risk and Recovery Considerations

Financial Impact

Commercial accounts often involve higher balances than consumer debts. As a result, the recovery process may justify:

-

More intensive investigation

-

Attorney involvement

-

Litigation strategies

Consumer accounts typically involve smaller balances but higher volume.

Litigation Differences

In consumer cases, litigation must strictly adhere to consumer protection laws and procedural requirements. In commercial cases, litigation strategy often centers on:

-

Enforcing contract terms

-

Pursuing breach of contract claims

-

Enforcing personal guarantees

-

Securing judgments against business assets

Because businesses may have identifiable assets or receivables, commercial judgments can sometimes be enforced more strategically.

Relationship Management

One unique aspect of commercial collections is the potential for ongoing business relationships. A creditor may want to recover funds while keeping the door open for future transactions.

In contrast, consumer collections rarely involve preserving a future commercial relationship.

An experienced agency understands how to balance recovery with professionalism in both scenarios.

Why the Distinction Matters for Creditors

Choosing the right collection strategy can significantly impact recovery results. Using a consumer-focused approach for a commercial account—or vice versa—can:

-

Reduce effectiveness

-

Increase legal risk

-

Delay resolution

-

Damage business relationships

Working with a collection agency experienced in both areas ensures that accounts are handled according to the appropriate legal framework and recovery strategy.

How We Approach Commercial and Consumer Accounts

Effective recovery begins with understanding the nature of the debt. Our approach includes:

-

Evaluating the account type and governing laws

-

Reviewing documentation and contractual rights

-

Implementing compliant communication strategies

-

Negotiating resolution based on financial realities

-

Escalating to legal remedies when appropriate

By tailoring our strategy to the specific account type, we maximize recovery while maintaining professionalism and compliance.

Final Thoughts

Commercial and consumer collections may share the same goal—recovering outstanding debt—but the similarities largely end there. Differences in regulation, strategy, documentation, and debtor profile require distinct approaches.

For businesses seeking recovery services, understanding these distinctions helps ensure that your accounts are handled efficiently, legally, and strategically.

If you have questions about your outstanding accounts or need guidance on the appropriate collection strategy, our team is here to help.