Commercial and consumer collections may share the same goal—recovering unpaid debt—but the rules, strategies, and risks are very different. This article breaks down the key differences in regulations, communication, documentation, and recovery strategies so businesses can choose the right approach for every account.

Category Archives: Accounts Receivables Management

Client Spotlight: How We Helped a Healthcare Provider Recover $50,000 in Aged Debt

Recovering aged healthcare receivables doesn’t have to mean writing them off. Learn how we helped a healthcare provider recover $50,000 in aged debt through compliant, patient-focused collection strategies—without disrupting patient relationships

How to Tighten Up Your Credit Policies to Reduce Delinquencies

Effective credit management starts long before an invoice is overdue. Learn how to build stronger credit policies, set smarter limits, and reduce delinquencies without damaging customer relationships.

Statute of Limitations on Debt: When Is It Too Late to Collect?

The statute of limitations defines how long a creditor has to pursue legal action to collect a debt. Learn when it’s too late to sue—and what it means for creditors and consumers.

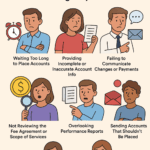

Common Mistakes to Avoid When Working with a Collection Agency

Working with a collection agency is a strategic move—but common mistakes can cost you results and time. Learn how to avoid the most frequent pitfalls and maximize recoveries.

Top Mistakes Businesses Make When Trying to Collect Debts — And How to Avoid Them

Many businesses sabotage their own collections by making common mistakes—like being too aggressive or failing to document communication. Learn how to recover what you’re owed more effectively.

The Importance of Compliance in Debt Collection: What Businesses Should Know

Understanding and complying with debt collection laws like FDCPA, Reg F, TCPA, and CFPB regulations is essential for protecting both consumers and your business. Learn what every business should know about compliance—and the risks of getting it wrong.

How Small Businesses Can Effectively Manage Late Payments

Managing late payments is crucial for small business success. Learn practical steps to prevent delinquencies and when to bring in expert help.

Debt Collection Technology: Tools Revolutionizing the Industry

Explore how technology is transforming debt collection. From predictive dialing to debtor analytics, learn how these tools are making recovery smarter and more efficient.

The Benefits of Hiring a Professional Debt Collector Versus In-House Collection

Deciding between in-house debt collection and outsourcing to a professional agency? Learn the pros and cons of each approach to maximize recovery while maintaining customer relationships.